Over the years, influencer marketing has grown massively. Influencers specialise in various industries, however, the majority strive to achieve the same goals: increasing brand awareness and increasing purchases on products or services.

While the term ‘influencer marketing’ can induce sighs and eye-rolls, there is a growing appreciation for the talent, skill, efforts, and value that influencers can bring. With the right portfolio, an influencer can provide a brand with otherwise unobtainable access to a huge proportion of their target market, with a level of trust that is much harder for a brand to ever achieve through their own means.

The growth of influencer marketing

As social media continues to grow, so does the occupation of ‘influencer’ as a main job title and source of income. That’s how far influencer marketing has come! The constant development of social media and the digital world means that influencers can offer and supply a much higher level of skills and resources than would have been the case a few years ago – for example, the launch of TikTok and Instagram Reels has provided many influencers with access to new followings and content creation abilities. The competition to make it into the influencer working world is extremely competitive – but the results for businesses using influencers as part of their marketing strategy can be vast!

At a value of $9.7bn in 2020, influencer marketing has clearly been popular for a while, particularly in the B2C space and emerging in B2B. It is in fact expected to grow to a whopping $15bn by 2022 globally. These figures imply that the demand for influencers will continue to grow and influencer marketing will be increasingly effective.

For extra validation on the evolution of influencer marketing, here are some key stats:

- 87% of people admit to buying something because an influencer encouraged them to.

- 73% of marketers say influencer marketing is ‘somewhat effective’ or ‘very effective’ for their brand.

- 71% of people who have a good experience with a brand on social media say they’re likely to recommend the brand to friends and relatives.

Based on all this, it would be a huge missed opportunity for the businesses in the financial sector to overlook the power of influencer marketing.

Influencer marketing in the financial services (FS) sector

In terms of the financial sector, Onalytica surveyed influencers asking them what they do and what they enjoy most and least. The results showed that 91% post social media content, 65% enjoy speaking at events the most, and 15% enjoy organising events and meet-ups least. With 91% of posting social media content and 63% enjoying speaking at events, the financial sector is heading in the right direction in terms of already being set up to work effectively within an influencer marketing program. The next step is to source the social media profiles of relevant influencers, and explore how a collaboration could benefit your FS brand.

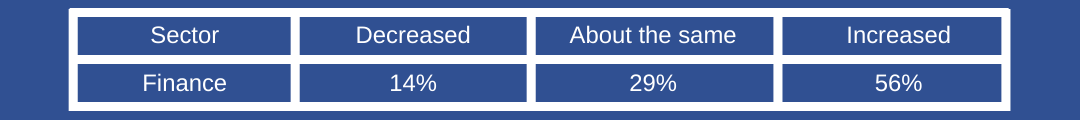

The same Onalytica report shows that during Covid-19, the financial sector saw the biggest net increase in influencer marketing. The results below show the changes in workload within the sector. This high increase of work could be due to the financial impact Covid-19 had and the support and guidance people needed, such as the furlough scheme.

It’s clear that influencer marketing is still a hot topic in the digital industry – and a growing opportunity for those working in FS. If you aren’t working with influencers, now is the time to get involved and experiment with the results this type of marketing could bring to your business.

If you have any questions, get in touch: [email protected]